Economists were stunned this week when the Labor Department reported a CPI increase more than twice as high as they had expected.

“I was surprised,” admits Fed Vice Chairman Richard Clarida. “We have pent-up demand in the economy. It may take some time for supply to rise up to demand.”

The Consumer Price Index (CPI) measures the average change in prices paid by consumers for goods and services. As reported Wednesday, the CPI increased 0.8% from March to April. The core CPI, which excludes food and energy markets, showed the most dramatic monthly increase since 1982.

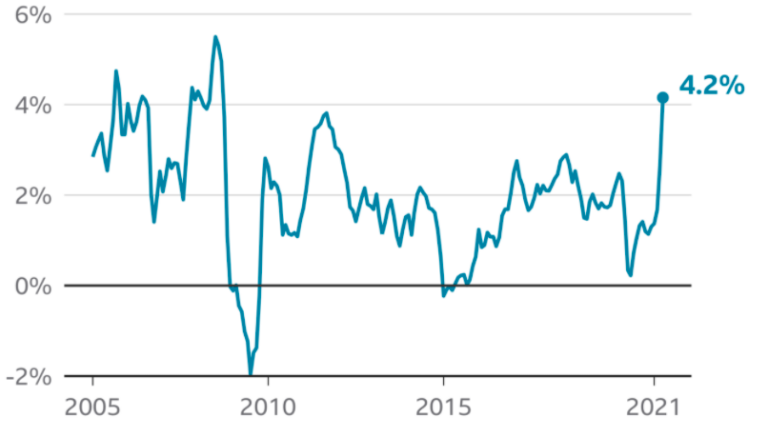

The annual CPI rose more than 4% – the highest since 2008. It is important to keep the reference point in mind. What we’re seeing here is known as the “base effect,” which occurs when a reference point (in this case, the pandemic-depressed index of April 2020) chosen for a comparison between two data points affects the result of the comparison.

Shelter and transportation services reported some of the highest price increases. That included a 10% jump in the cost of used vehicles that represents over one-third of the total CPI increase.

Surges in the cost of airfare and hotel rooms were the largest on record. Increases for auto rental, car insurance, and public transportation broke a record set in 1975. Energy prices are up 25% from last year, including a nearly 50% increase in the price of gasoline that drove fuel costs over $3 per gallon for the first time since 2014. Lumber prices have increased by more than 120% over the past year and copper is up nearly 36%.

Federal officials insist inflation rates will settle down as the economy continues to reopen, but others aren’t so sure.

“Transitory pandemic influences clearly contributed to the surprise but there’s residual firmness in core inflation that’s hard to ignore,” explains Barclays economist Michael Gapen. “There was still some residual firmness that suggests risk around inflation in the near term are still skewed to the upside.”

Contributing to price increases are widespread issues with supply chains that the pandemic caused. Rising consumer demand has given some businesses the confidence to pass added costs to consumers. However, sustained problems with supply chains could speed inflation.

Already, investors are selling stocks in fear that climbing inflation will convince the Fed to increase interest rates faster than planned. News of the record-breaking CPI increase produced dips in major stock markets including the S&P (-2.4%), Dow (-2%), and Nasdaq (2.7%).

Author’s Note: Thursday’s report could be the first rumble of a major economic earthquake.

We typically control inflation by raising interest rates. But we can’t do that now because it would exacerbate the national debt and potentially bankrupt the government. And since the Biden Administration is passing bills that will dramatically increase the national debt, inflation could quickly get out of control.

Sources:

US Consumer Prices Outpace Estimates With Biggest Spike Since 2009

Inflation speeds up in April as consumer prices leap 4.2%, fastest since 2008

US inflation sees biggest jump since 2008

Dow hit with 682 point loss, Nasdaq off 2.7% on inflation beating

Direct Shipped Ups Amoxicilina Saturday Delivery Internet

Generic Deltasone

Comments are closed.